- English

- Español

- Português

- русский

- Français

- 日本語

- Deutsch

- tiếng Việt

- Italiano

- Nederlands

- ภาษาไทย

- Polski

- 한국어

- Svenska

- magyar

- Malay

- বাংলা ভাষার

- Dansk

- Suomi

- हिन्दी

- Pilipino

- Türkçe

- Gaeilge

- العربية

- Indonesia

- Norsk

- تمل

- český

- ελληνικά

- український

- Javanese

- فارسی

- தமிழ்

- తెలుగు

- नेपाली

- Burmese

- български

- ລາວ

- Latine

- Қазақша

- Euskal

- Azərbaycan

- Slovenský jazyk

- Македонски

- Lietuvos

- Eesti Keel

- Română

- Slovenski

- मराठी

- Srpski језик

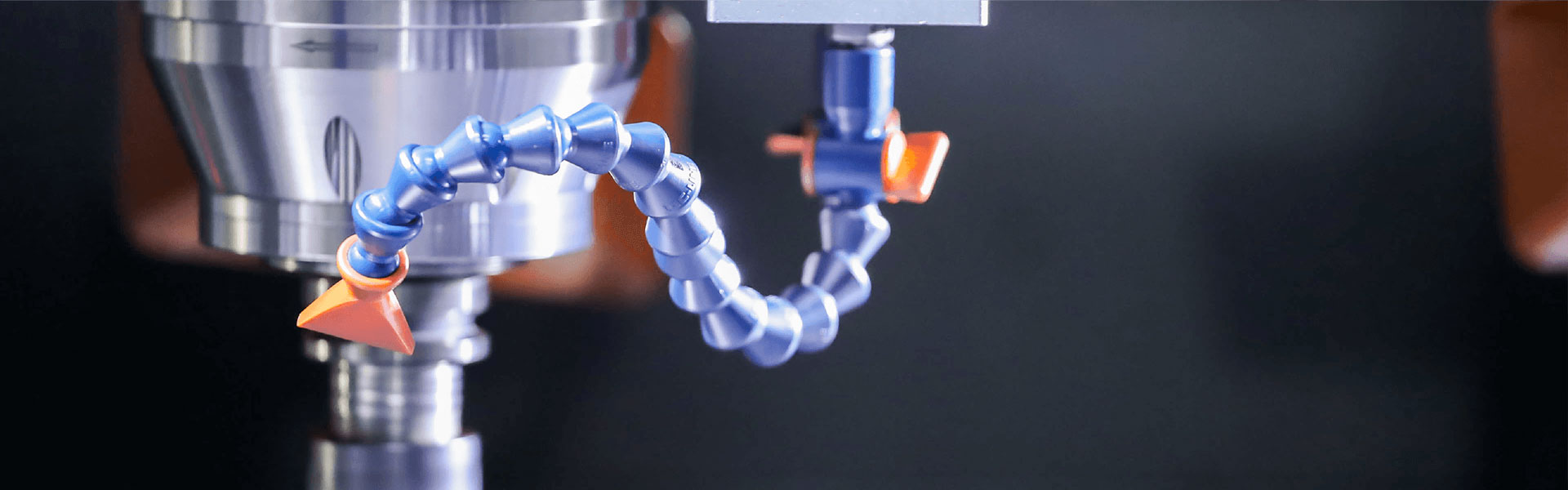

Chip shortage continues to be a problem

2023-04-11

While there is currently an oversupply of memory semiconductors due to a sluggish global economy, analog chips for automotive and industrial applications remain in short supply. Lead times for these analog chips can be as long as 40 weeks, compared to around 20 weeks for memory stocks.

Semiconductor lead times had been increasing until the first half of last year, reaching a peak of 25.7 weeks in January 2020. However, due to the pandemic and reduced demand for semiconductors, lead times dropped to 27 weeks in the middle of last year and further decreased to 24 weeks as of the start of this year.

Despite this, some semiconductors continue to experience supply shortages. McKinsey, a global consulting firm, has analyzed semiconductor shortages and found that about 90% of the demand driven by shortages is related to mature technologies. In particular, about 75% of all demand driven by shortages involves integrated circuits such as voltage regulators, accounting for about 66% of demand, and discrete semiconductors such as MOSFETs, accounting for about 10% of demand.

It is also worth noting that the DRAM market is expected to be oversupplied in the first three quarters of 2023 due to reduced production of consumer electronics, PCs, and smartphones. The lead times for DRAM peaked at 22 weeks in mid-2022 but are expected to drop to 19 weeks in early 2023.

Overall, the semiconductor industry is facing a complex and constantly evolving situation, with some types of semiconductors experiencing oversupply while others face significant shortages. We hope this update provides some useful insights into the current state of the industry.

Semiconductor lead times had been increasing until the first half of last year, reaching a peak of 25.7 weeks in January 2020. However, due to the pandemic and reduced demand for semiconductors, lead times dropped to 27 weeks in the middle of last year and further decreased to 24 weeks as of the start of this year.

Despite this, some semiconductors continue to experience supply shortages. McKinsey, a global consulting firm, has analyzed semiconductor shortages and found that about 90% of the demand driven by shortages is related to mature technologies. In particular, about 75% of all demand driven by shortages involves integrated circuits such as voltage regulators, accounting for about 66% of demand, and discrete semiconductors such as MOSFETs, accounting for about 10% of demand.

It is also worth noting that the DRAM market is expected to be oversupplied in the first three quarters of 2023 due to reduced production of consumer electronics, PCs, and smartphones. The lead times for DRAM peaked at 22 weeks in mid-2022 but are expected to drop to 19 weeks in early 2023.

Overall, the semiconductor industry is facing a complex and constantly evolving situation, with some types of semiconductors experiencing oversupply while others face significant shortages. We hope this update provides some useful insights into the current state of the industry.