- English

- Español

- Português

- русский

- Français

- 日本語

- Deutsch

- tiếng Việt

- Italiano

- Nederlands

- ภาษาไทย

- Polski

- 한국어

- Svenska

- magyar

- Malay

- বাংলা ভাষার

- Dansk

- Suomi

- हिन्दी

- Pilipino

- Türkçe

- Gaeilge

- العربية

- Indonesia

- Norsk

- تمل

- český

- ελληνικά

- український

- Javanese

- فارسی

- தமிழ்

- తెలుగు

- नेपाली

- Burmese

- български

- ລາວ

- Latine

- Қазақша

- Euskal

- Azərbaycan

- Slovenský jazyk

- Македонски

- Lietuvos

- Eesti Keel

- Română

- Slovenski

- मराठी

- Srpski језик

GaN Market Changes

2025-07-14

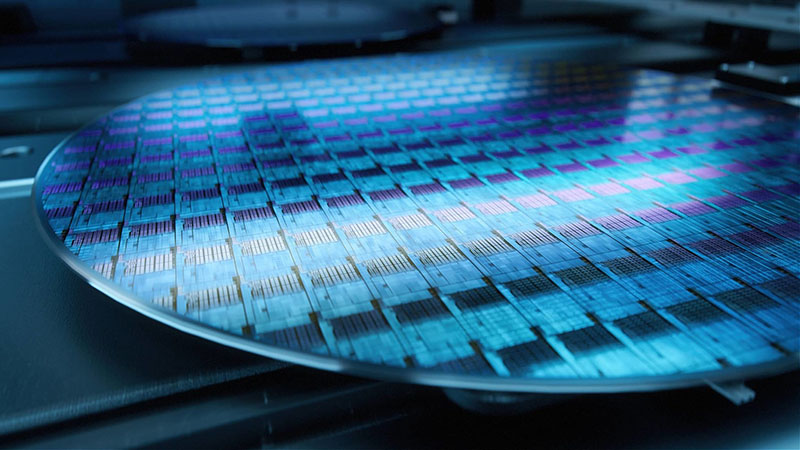

Silicon carbide (SiC) is currently facing challenges in the "price war," while gallium nitride (GaN) is emerging as a key player in the next technological battlefield. Recently, a series of significant developments has brought GaN into the spotlight. TSMC announced its decision to completely exit the GaN foundry business within two years; Powerchip quickly took over the orders from Navitas; Infineon has begun mass production of 12-inch GaN wafers; Renesas Electronics has paused its SiC development and is increasing investments in GaN; STMicroelectronics and Innoscience have deepened their partnerships in terms of capital and production lines. These events indicate that GaN is moving from serving "edge devices" to becoming a central component in the industry.

1. TSMC withdraws:

Strategic contraction under "losing heat" of profits In early July, TSMC confirmed that it would gradually withdraw from its GaN foundry business within two years, citing "continuous decline in profit margins", especially under the price pressure brought by the rapid rise of Chinese manufacturers. It is reported that the decision was made by TSMC's senior management in mid-June, involving the gradual shutdown of the 200mm GaN wafer line and the orderly migration of customer business. TSMC's withdrawal reveals the bottleneck of the game between IDM and foundry models in the low-cost GaN track, and also opens a "window of succession" for other foundry manufacturers and IDM companies.

2. Infineon expands against the trend:

Compared with TSMC's "stop loss" in the sprint for 12-inch GaN mass production, IDM giant Infineon chose to expand against the trend. According to its official news, Infineon has achieved 300mm GaN wafer technology development on the existing production line and plans to deliver the first batch of samples to customers in Q4 2025.

The production efficiency of 300mm (12-inch) wafers is 2.3 times higher than that of 200mm, while reducing unit cost and energy consumption, paving the way for large-scale commercial use of GaN devices. Infineon emphasizes that GaN has higher power density, switching speed and lower energy consumption, and is suitable for multiple scenarios from fast charging, data centers to industrial robots, photovoltaic inverters, etc. This marks that the GaN industry chain is entering a new stage of "technology-scale synergy".

3. Renesas Turns Around:

The Logic Behind Abandoning SiC and Embracing GaN Renesas Electronics originally bet on SiC and signed a $2 billion long-term wafer supply agreement with Wolfspeed, planning to build a plant in Takasaki, Japan in 2025 to mass-produce automotive-grade SiC devices. However, the plan was called off in early 2025. According to the Nikkei News, Renesas not only disbanded the SiC project team, but also prepared to sell the SiC production line equipment at the Takasaki plant and restart the silicon-based business and GaN R&D line.

The logic behind this is, on the one hand, the slowdown in the automotive market and the overcapacity of SiC; on the other hand, Wolfspeed's financial turmoil and yield sluggishness have dragged down Renesas' project rhythm. GaN, with its advantages of light assets, short cycles, and cost control, has become an alternative path for Renesas. Its core technology comes from Transphorm, which was acquired in 2023. The latest generation of SuperGaN platform continues to iterate on key indicators such as chip area, RDS(on), and FOM, locking in high-power and high-efficiency scenarios.

4. ST and Innoscience:

“Lock-up” cooperation deepens binding As a typical case of international giants deeply cultivating China's third-generation semiconductor ecology, ST's layout in the GaN track is particularly eye-catching. At the end of 2024, ST became the largest cornerstone investor of Innoscience's listing in Hong Kong, holding 2.56% of the shares, and the original lock-up period was scheduled to be until June 2025. On the eve of the lifting of the ban, ST announced that the lock-up period would be extended by another 12 months to June 2026, sending a signal of long-term optimism and deep binding. Not only that, the two parties signed a technical cooperation agreement in March 2025, stipulating that ST can use Innoscience's 8-inch GaN production line in the mainland for localized manufacturing, and Innoscience can also use ST's overseas production line to expand the global market. This "industry + capital + manufacturing" trinity binding has become an important signal for the accelerated integration of the global GaN industry chain.

5. The rise of Chinese players:

Domestic GaN manufacturers continue to increase their production in the fields of fast charging, LED power supply, electric two-wheeled vehicles, data centers, etc., forming an industry advancement rhythm of "application first, manufacturing follow-up".

Semicorex offers high-quality ceramic products. If you have any inquiries or need additional details, please don't hesitate to get in touch with us.

Contact phone # +86-13567891907

Email: sales@semicorex.com